-

0 %

-

Share

We recommend a Desktop or Laptop Computer for the best performance.

![]() We recommend Google Chrome for the best performance.

We recommend Google Chrome for the best performance.

Comparative sentence

Review the conversation "How Do I Invest My Inheritance?". Do multiple choice questions to review comparative and superlative sentences and the new vocabulary that you just learned.

Free Members can take only 1 lesson per day, up to 10 lessons in total.

Free Members cannot take the Premium Lessons.

You reached the maximum 10 lessons for free members. Premium Members have no limit.

It looks like this lesson is inactive.

Become a Premium Member and take ALL LESSONS!

* To prevent abuse by bots, there is a limit of 300 lessons per month per account.

The suggestion might not be the right answer or the best answer. You still have to think hard before using it!

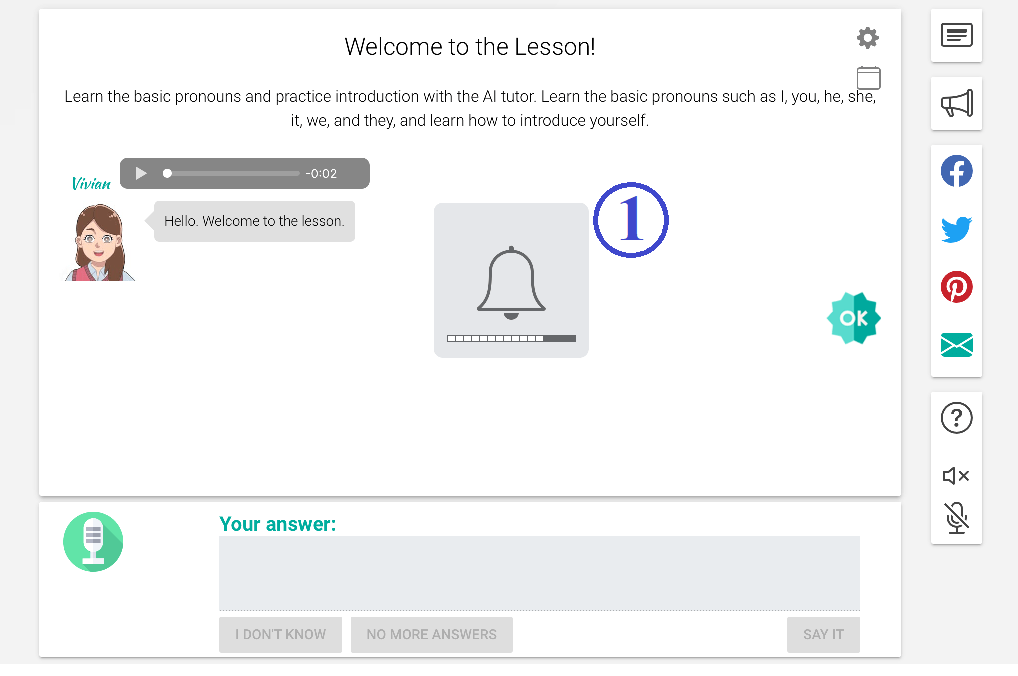

Did you hear the sound?

Good!

The silent mode is currently set to ON. Turn off the silent mode to hear the audio in the lesson.

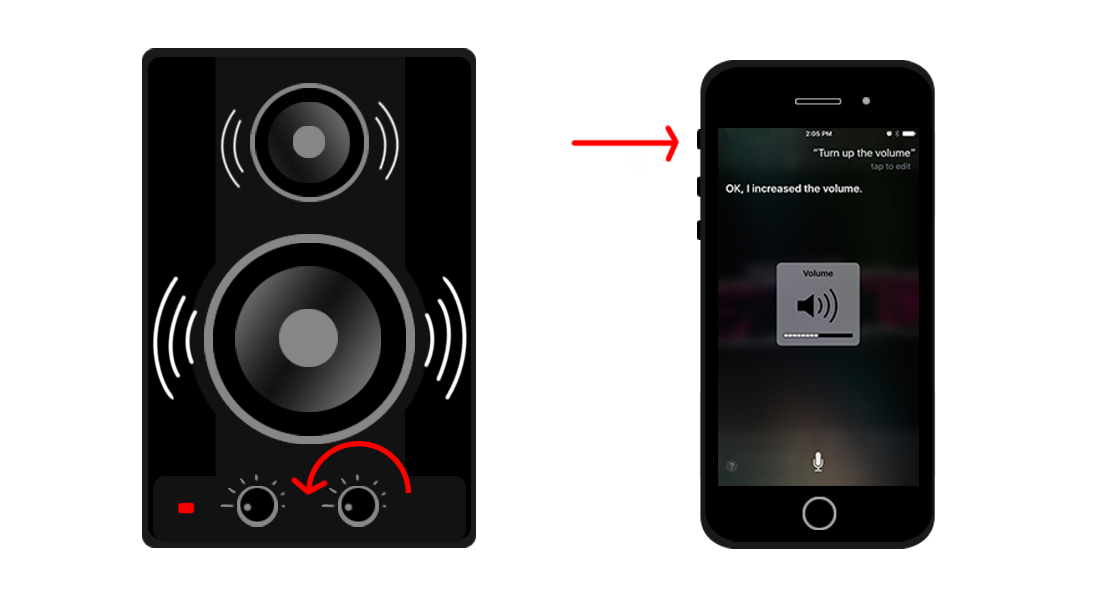

Try to turn on your speakers or turn up the volume.

Or change your browser setting.

If you still cannot hear the sound, don't worry. You can still do the lesson using the silent mode. (You can change the setting in the lesson.)

You need to allow audio playback.

You need to change your browser setting.

Or, you can do the lesson using the silent mode (without the sound).

Audio is not supported in your browser.

To play sound, please use the latest version of Google Chrome or Microsoft Edge.

You can do the lesson using the silent mode (without the sound).

Click to Test

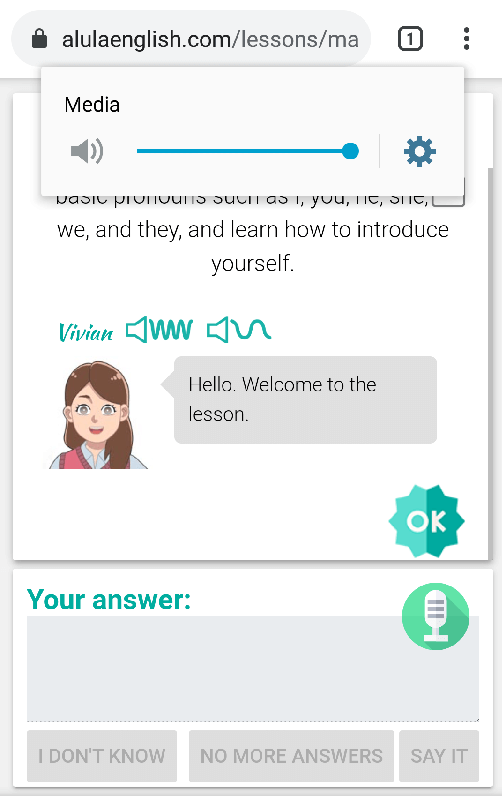

You said: ""

If you see the results above, then your microphone is working.

If you don't see anything, try to speak loudly into your microphone or read our guide for help.

Your microphone is not working.

Make sure your microphone is plugged in and is working properly.

Or, change your browser setting.

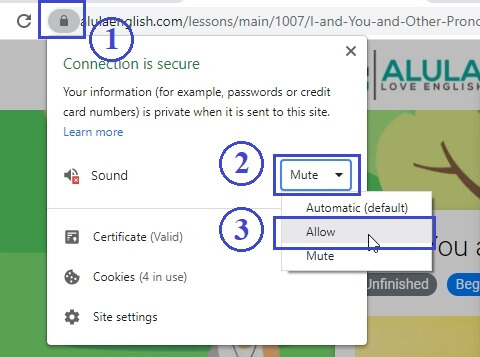

Click on the (1) Green icon on the browser bar, then, click on the (2) Sound dropdown. Select (3) Allow.

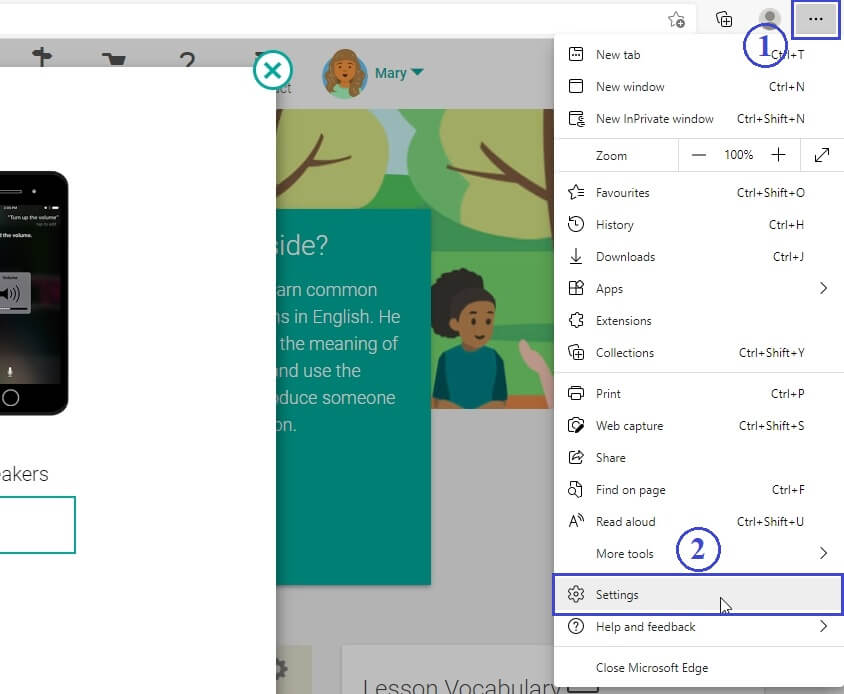

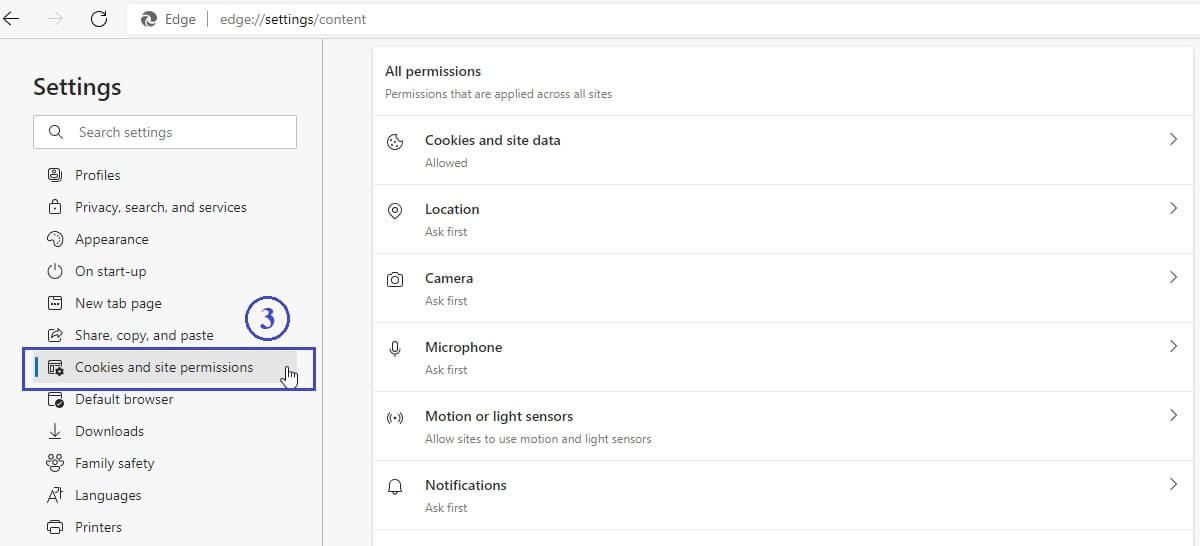

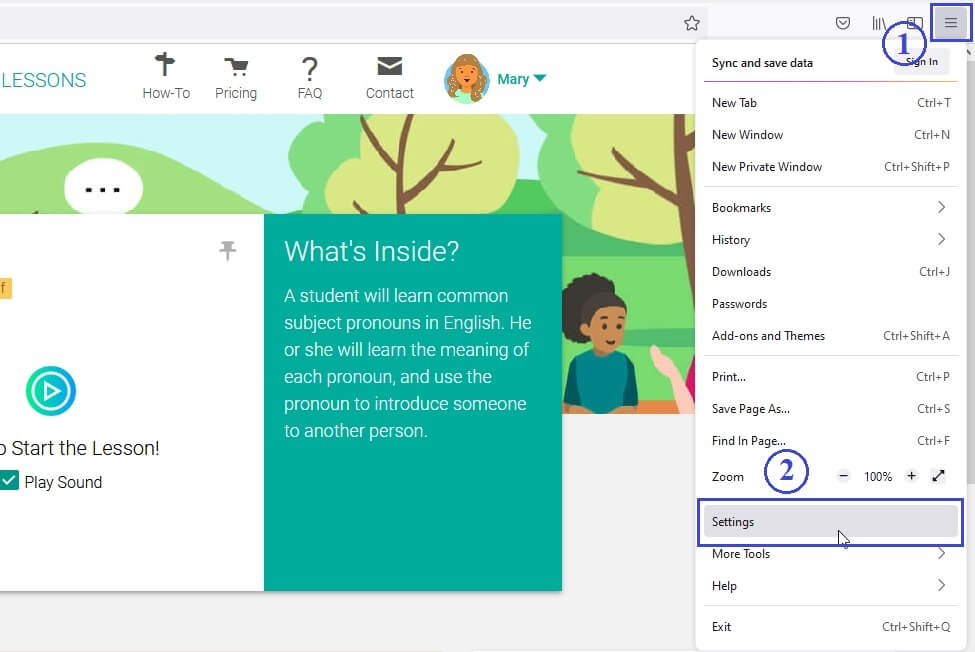

Click on the (1) Settings icon, then, click on the (2) Settings menu item.

Click on (3) Cookies and site permissions.

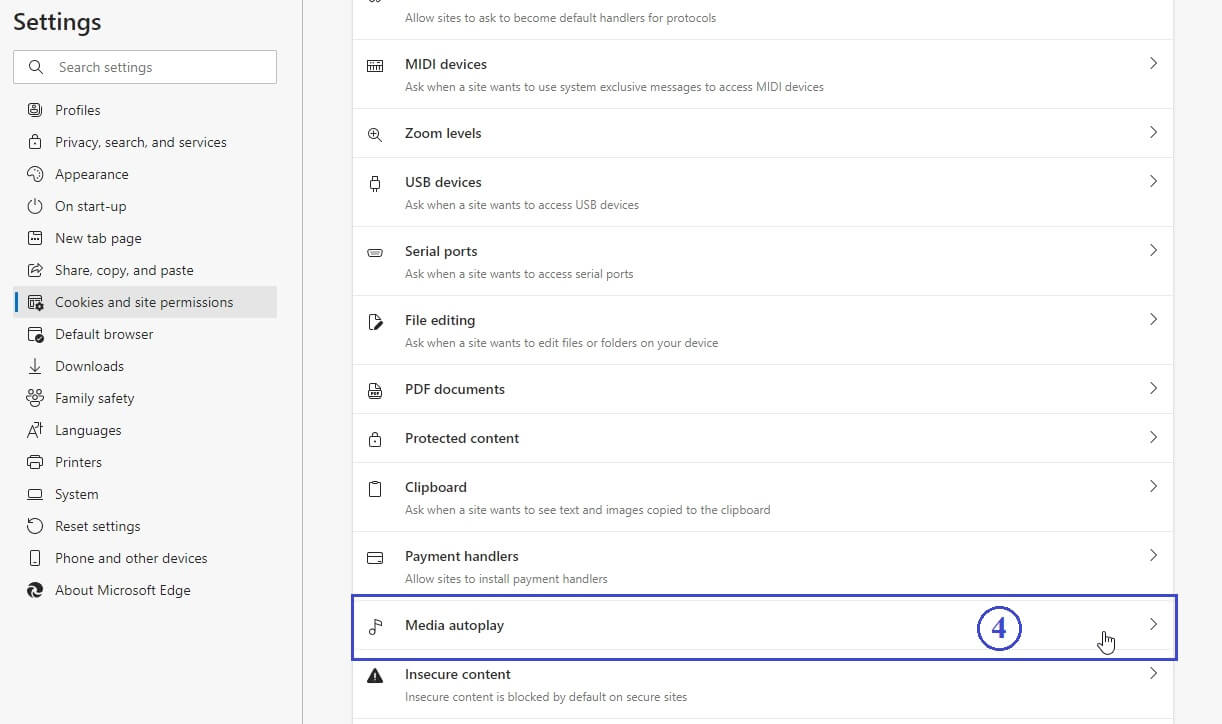

Click on (4) Media autoplay.

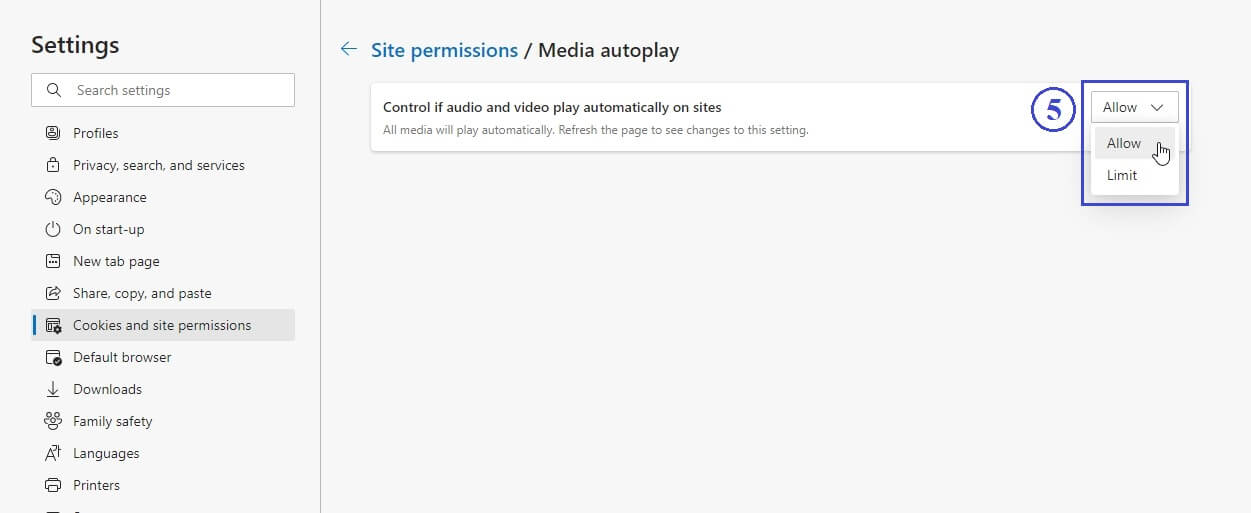

Select (5) Allow for "Control if audio and video play automatically on sites".

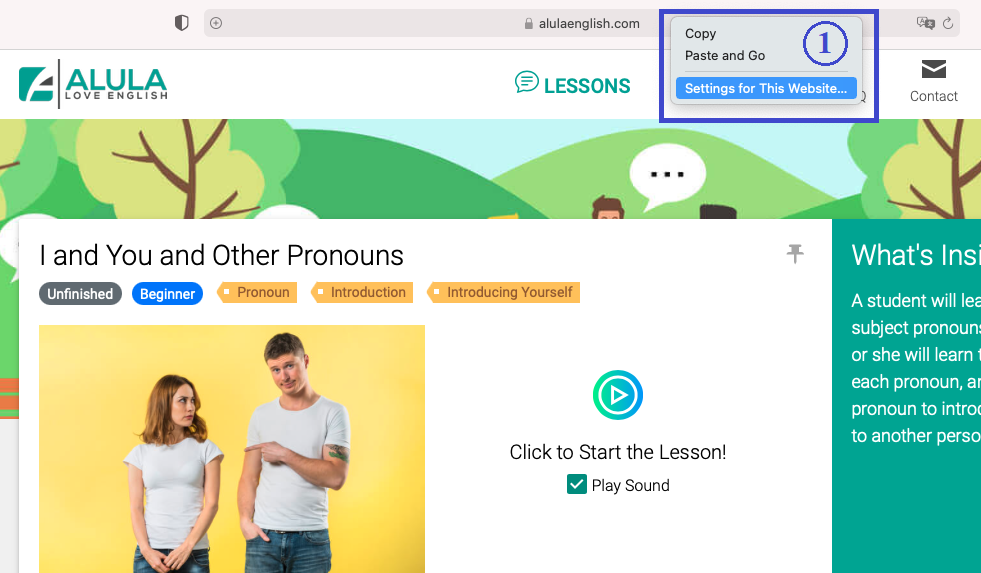

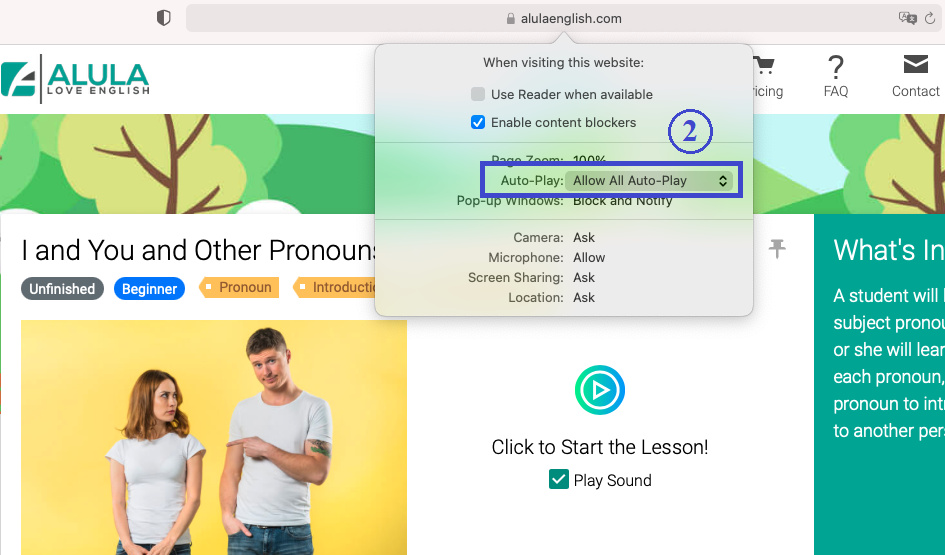

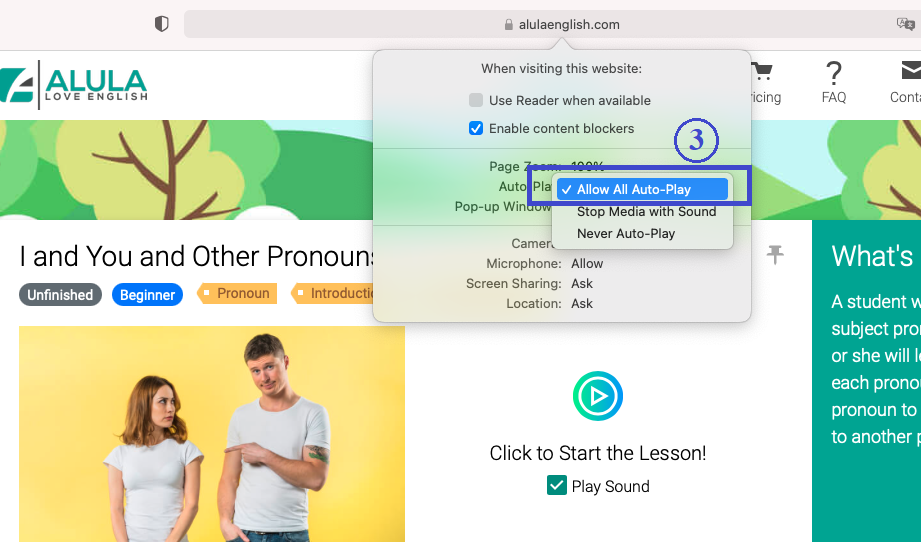

On the browser address bar, control-click, and select (1) Settings for This Website...

Click on the menu for (2) Auto-Play.

Select (3) Allow All Auto-Play.

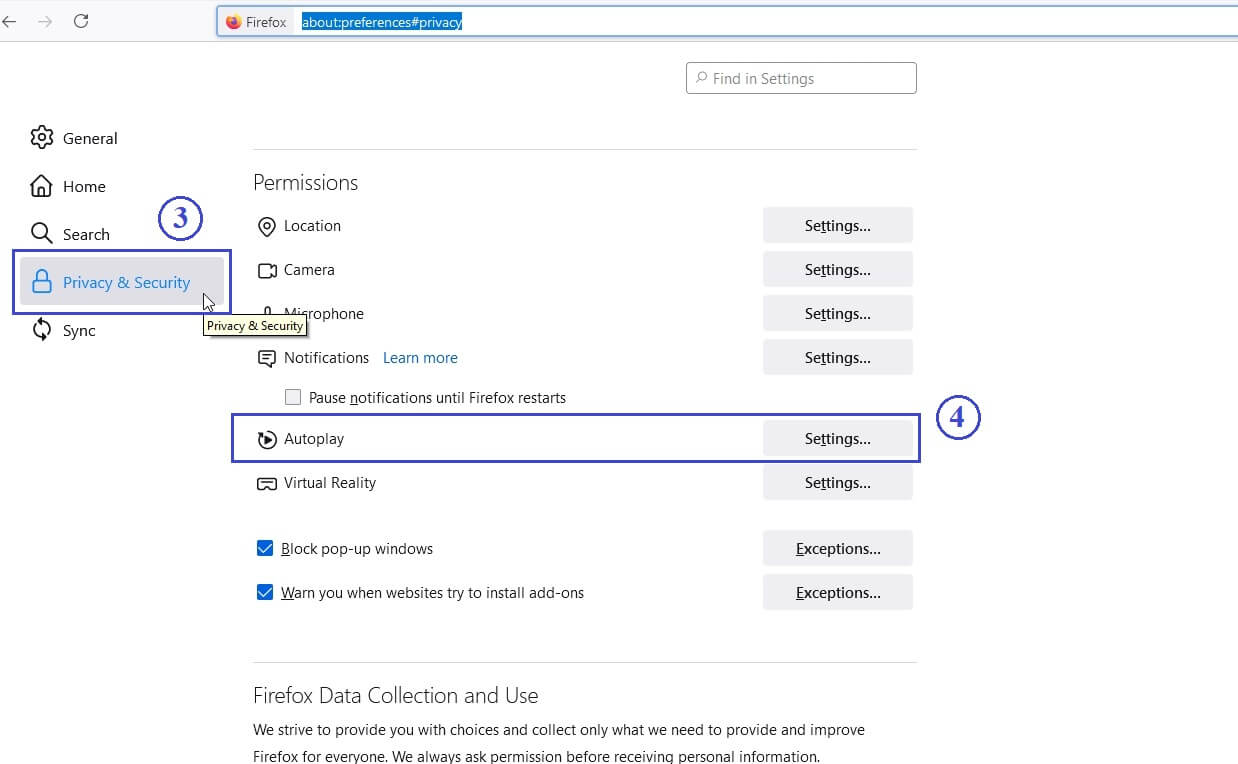

Click on the (1) Settings icon, then, click on the (2) Settings menu item.

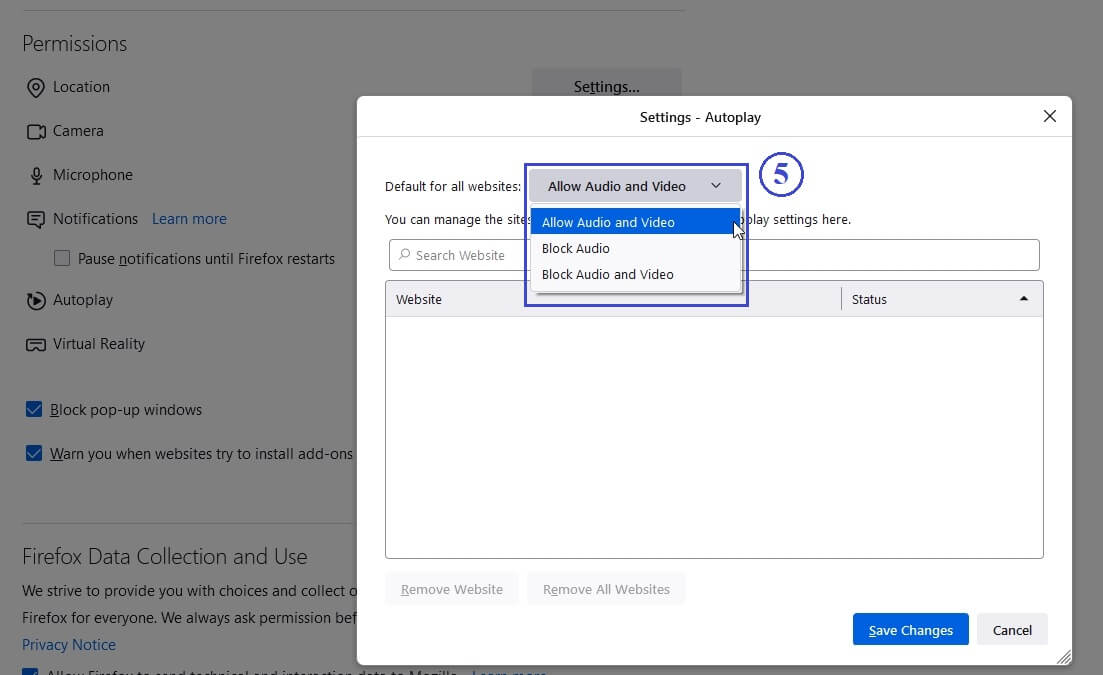

Click on the (3) Privacy & Security tab, then, click on the (4) Settings... menu item for Autoplay.

Select (5) Allow Audio and Video option.

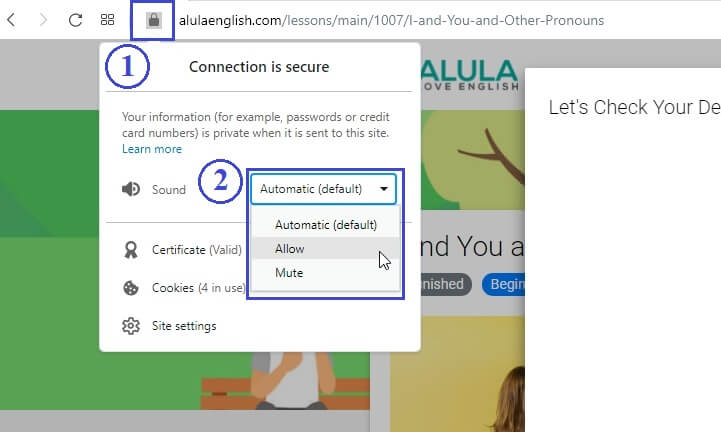

Click on the (1) Green icon on the browser bar, then, click on the (2) Sound dropdown and select "Allow".

Please make sure that your volume is turned up. Check that your device can play sound.

Please make sure that your volume is turned up. Check that your device can play sound.

Please turn up your volume. Also, please make sure your speaker is working.

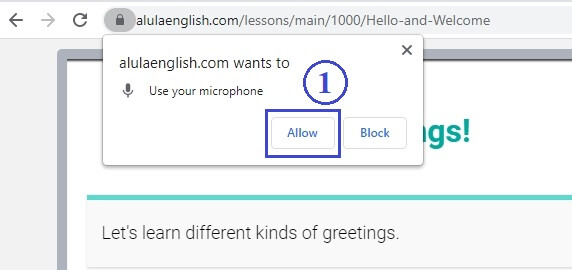

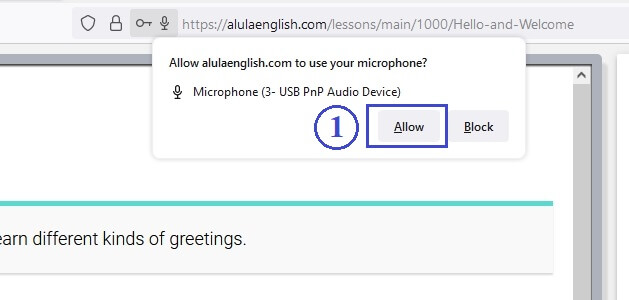

When the browser asks you, click on (1) Allow button.

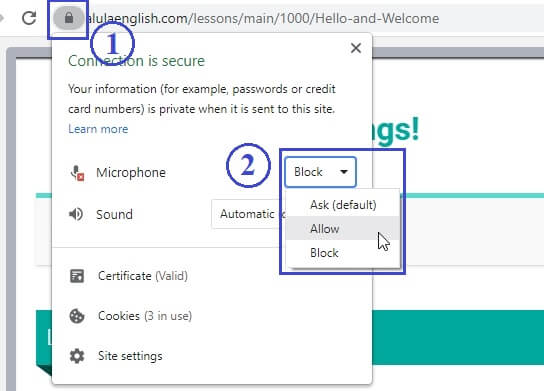

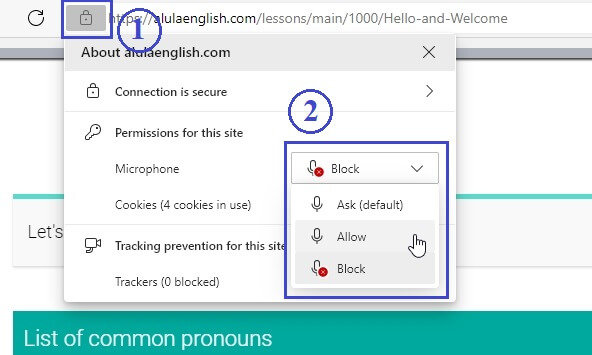

If you blocked the microphone already, click on the (1) green lock icon, then select (2) Allow under Microphone dropdown.

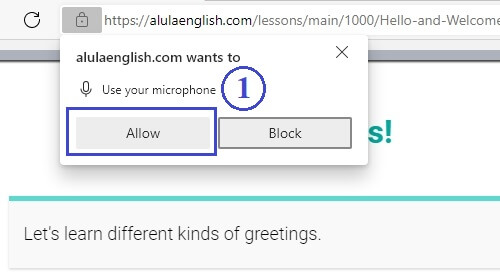

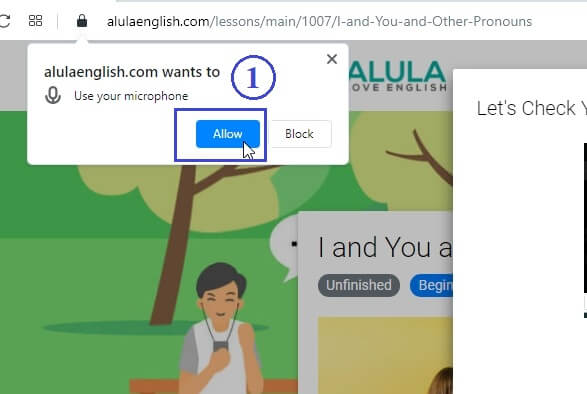

When the browser asks you, click on (1) Allow button.

If you blocked the microphone already, click on the (1) lock icon, then select (2) Allow under Microphone dropdown.

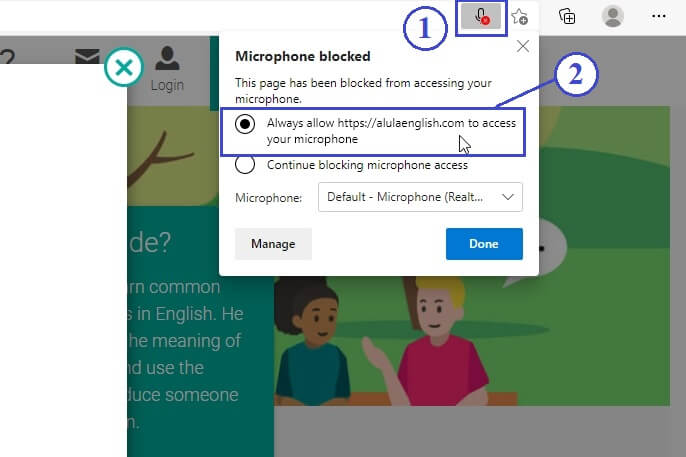

Sometimes, there is a (1) microphone icon at the right side. Click on it, then select (2) "Always allow https://alulaenglish.com to access your microphone".

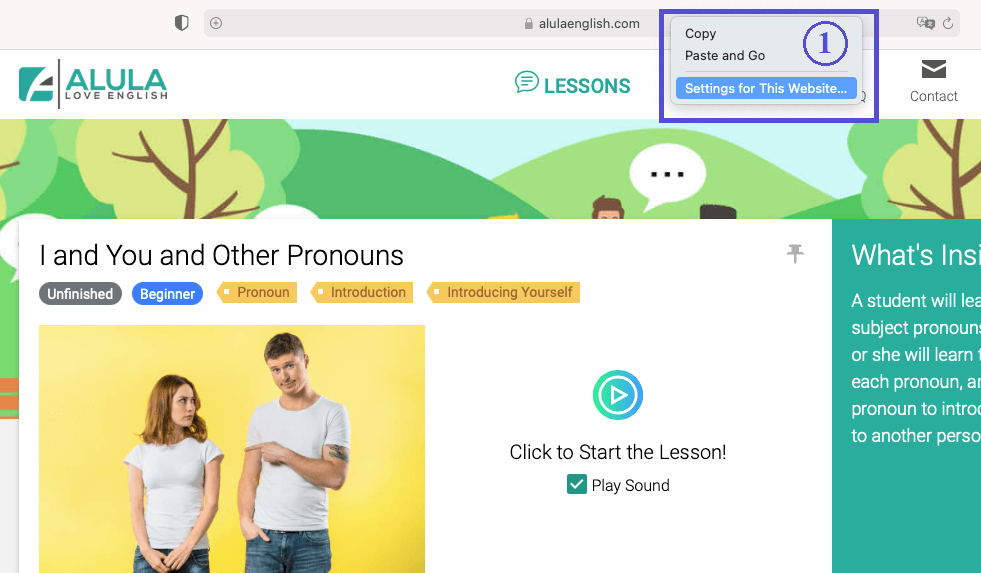

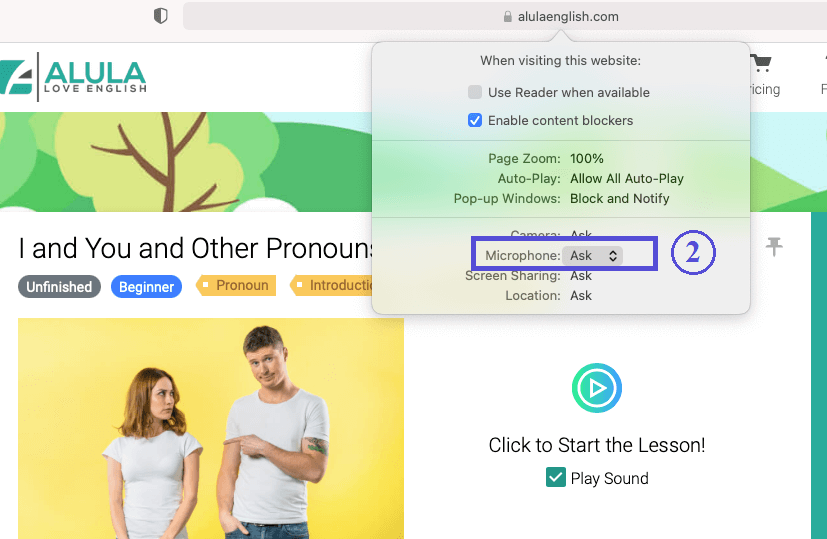

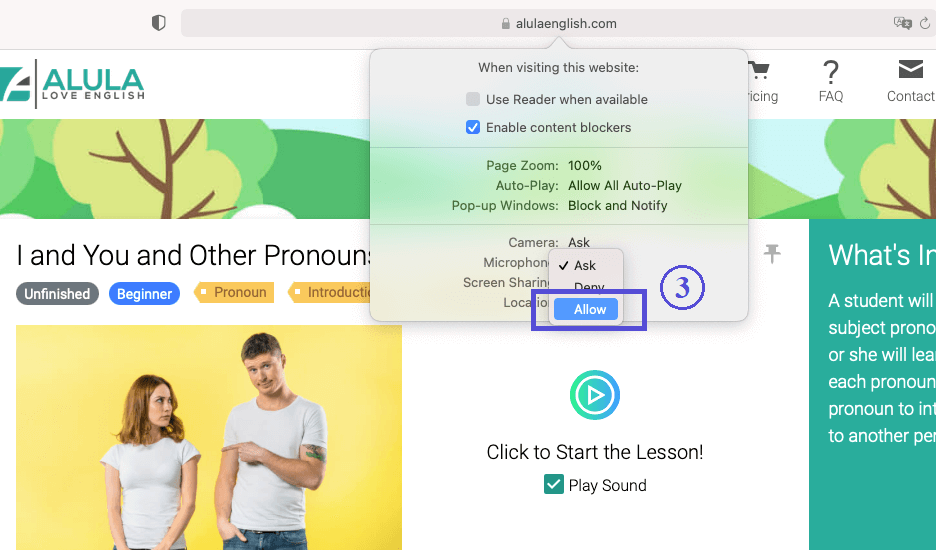

On the browser address bar, control-click, and select (1) Settings for This Website...

Click on the (2) Microphone dropdown.

Select (3) Allow.

When the browser asks you, click on (1) Allow button.

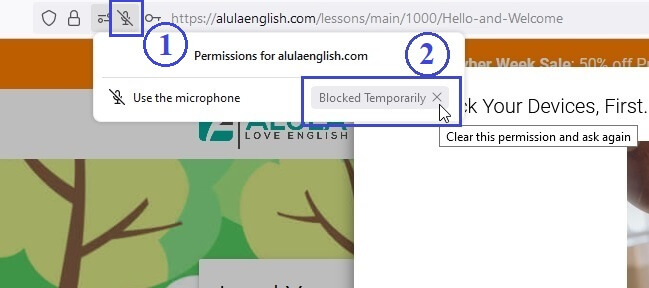

If you blocked the microphone already, click on the (1) microphone icon, then click the (2) X in the Blocked Temporarily button.

When the browser asks you, click on (1) Allow button.

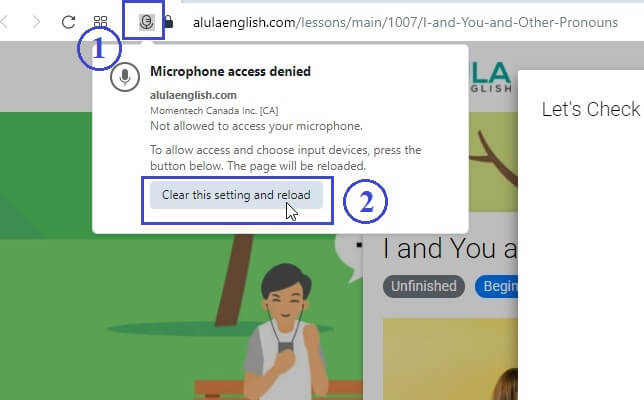

If you blocked the microphone already, click on the (1) microphone icon, then click the (2) Clear this setting and reload button.

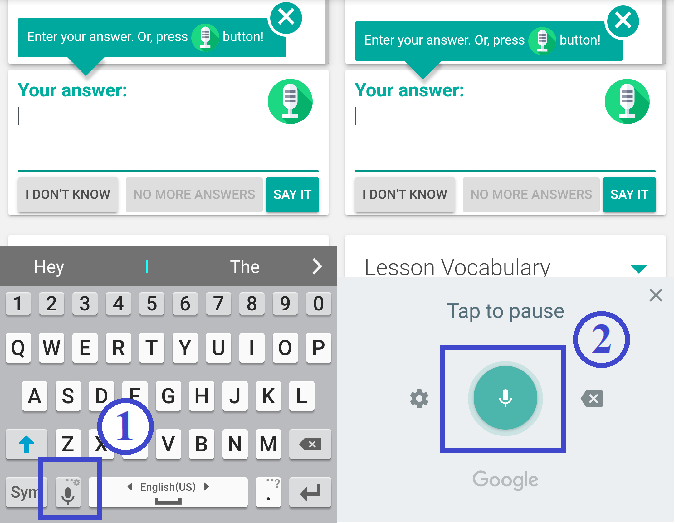

On your iPhone or iPad keyboard, click on the (1) microphone icon.

(2) Speak into your iPhone or iPad microphone directly.

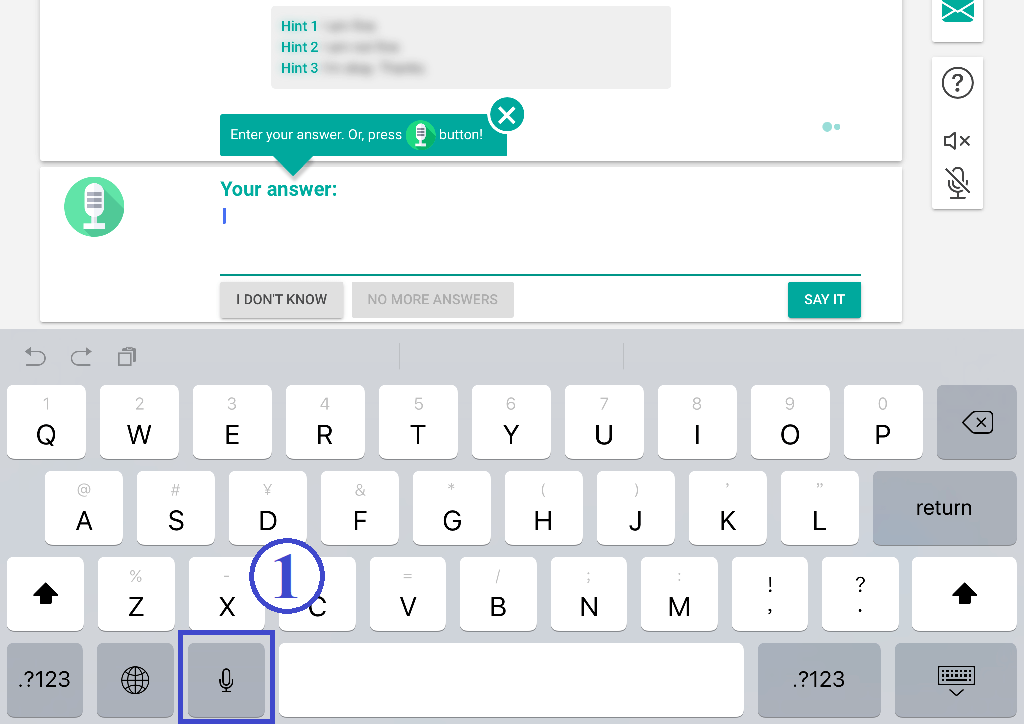

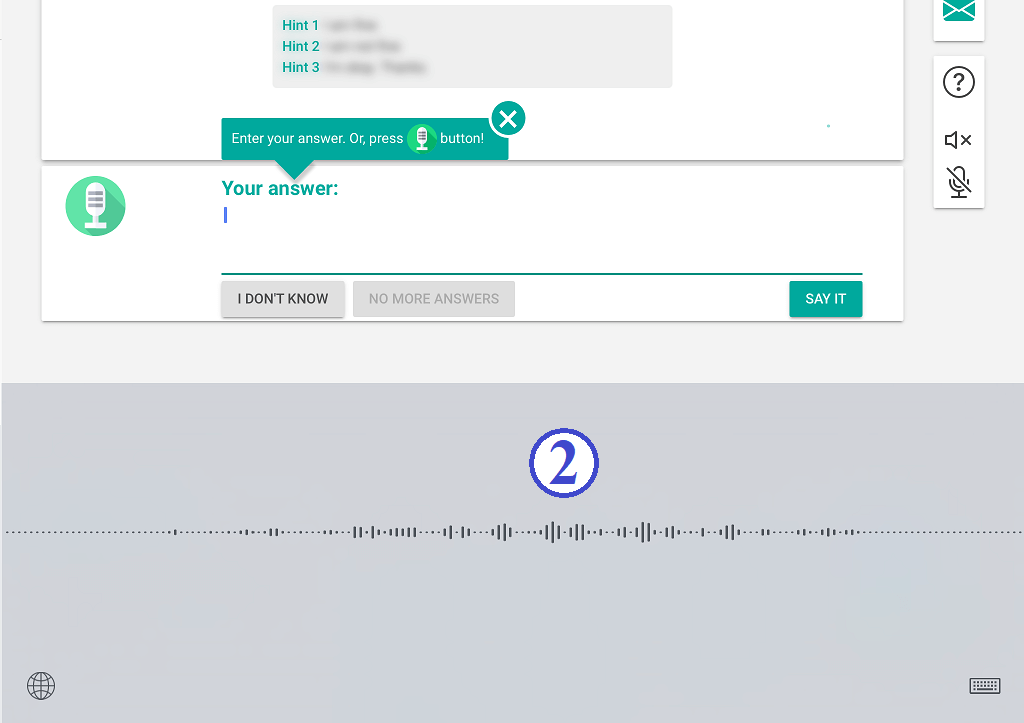

Click on the answer area and the Android keyboard will show up. Click the (1) Microphone button. Then, use (2) the Android voice recorder to record your voice.

ALULA the AI English Tutor

Copyright © 2024 All rights reserved

About

View the website in the following languages

Created by education experts, powered by AI and a whole bunch of ♥

There were some errors and we couldn't sign you up. Please check the information you provided.

We could not send the confirmation email to your email address. Please check your email address and try it again.

Enter a longer display name.

The email address is not valid.

This email is already registered. Log in

Minimum 8 characters.

By signing up, you agree to our Terms and Conditions, Privacy Policy, and Cookie Policy.

Login failed. Please check your email address and password.

Your email is verified successfully. Please log in.

An email has been sent to your email address.

Click on the button in the email to verify your email address and activate your account.

Email is resent to you. If you don't see it, check your spam folder.

Email was not sent due to an error. Please try again.

We could find your email record. Please try to refresh your screen, then log in to your account.

This email has already been activated. Log in.

If you don't see the email, click on the link below to have it resent to you.

Notice

We and selected partners use cookies or similar technologies as specified in the cookie policy.