-

0 %

-

Partager

We recommend a Desktop or Laptop Computer for the best performance.

![]() We recommend Google Chrome for the best performance.

We recommend Google Chrome for the best performance.

Leçon PREMIUM

Obtenez un Abonnement Premium et suivez Tous les cours et Leçons.

Comparative sentence Business Investment

Review the conversation "The Tale of Dot-Com Bubble". Do questions to review comparative adjectives and business and investment terminology.

Les membres gratuits peuvent suivre seulement 1 leçon par jour, jusqu'à 10 leçons au total.

Les membres gratuits ne peuvent pas suivre les leçons Premium.

Vous avez atteint le maximum de 10 leçons pour les membres gratuits. Les membres Premium n’ont aucune limite.

Il semble que cette leçon soit inactive.

Devenez un Membre Premium et suivez TOUTES LES LEÇONS< /b> !

* Pour éviter les abus des robots, il existe une limite de 300 leçons par mois et par compte.

The suggestion might not be the right answer or the best answer. You still have to think hard before using it!

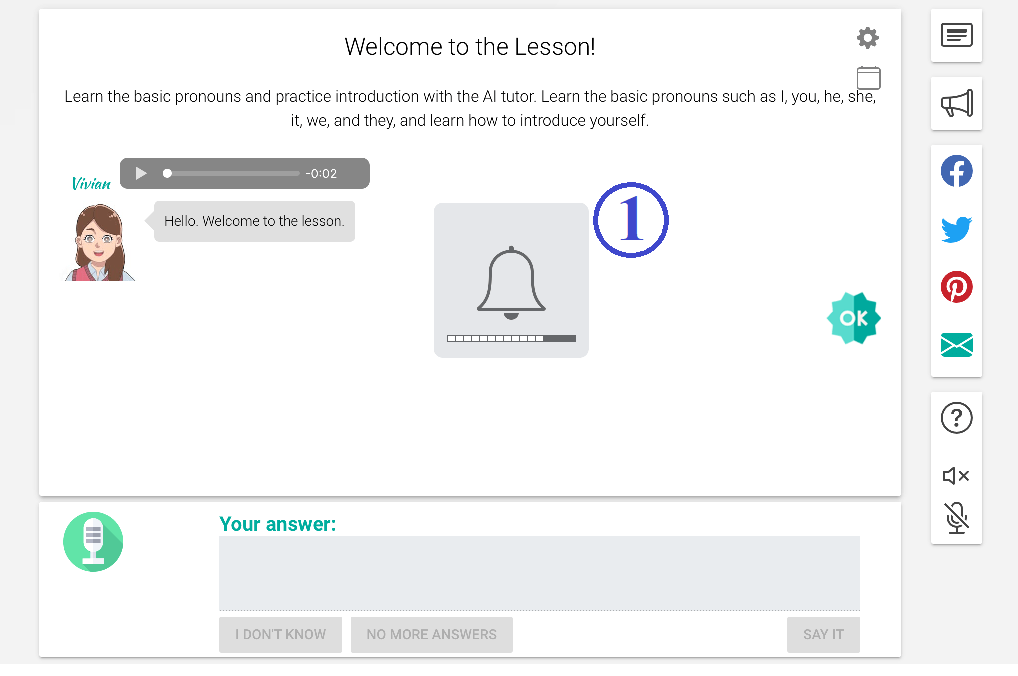

Did you hear the sound?

Good!

The silent mode is currently set to ON. Turn off the silent mode to hear the audio in the lesson.

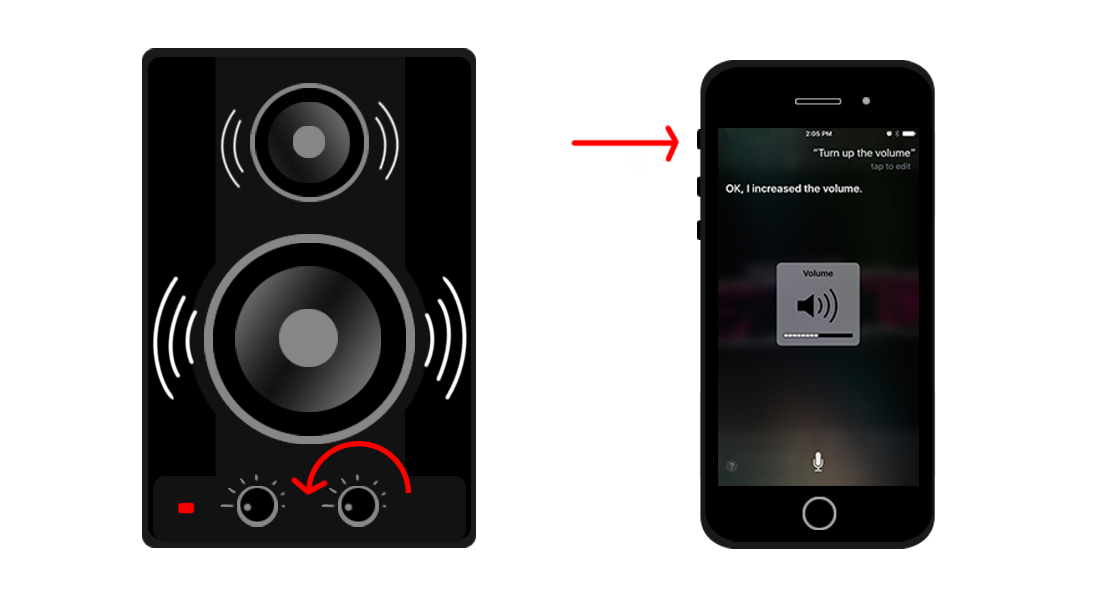

Try to turn on your speakers or turn up the volume.

Or change your browser setting.

If you still cannot hear the sound, don't worry. You can still do the lesson using the silent mode. (You can change the setting in the lesson.)

You need to allow audio playback.

You need to change your browser setting.

Or, you can do the lesson using the silent mode (without the sound).

Audio is not supported in your browser.

To play sound, please use the latest version of Google Chrome or Microsoft Edge.

You can do the lesson using the silent mode (without the sound).

Click to Test

You said: ""

If you see the results above, then your microphone is working.

If you don't see anything, try to speak loudly into your microphone or read our guide for help.

Your microphone is not working.

Make sure your microphone is plugged in and is working properly.

Or, change your browser setting.

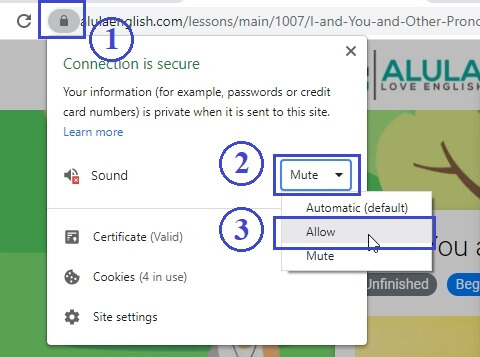

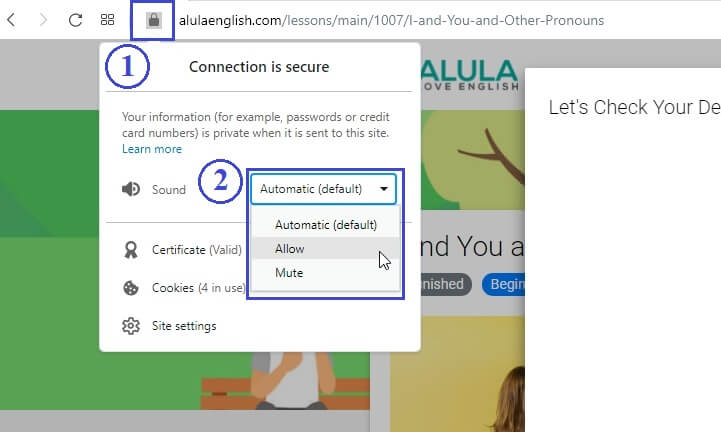

Click on the (1) Green icon on the browser bar, then, click on the (2) Sound dropdown. Select (3) Allow.

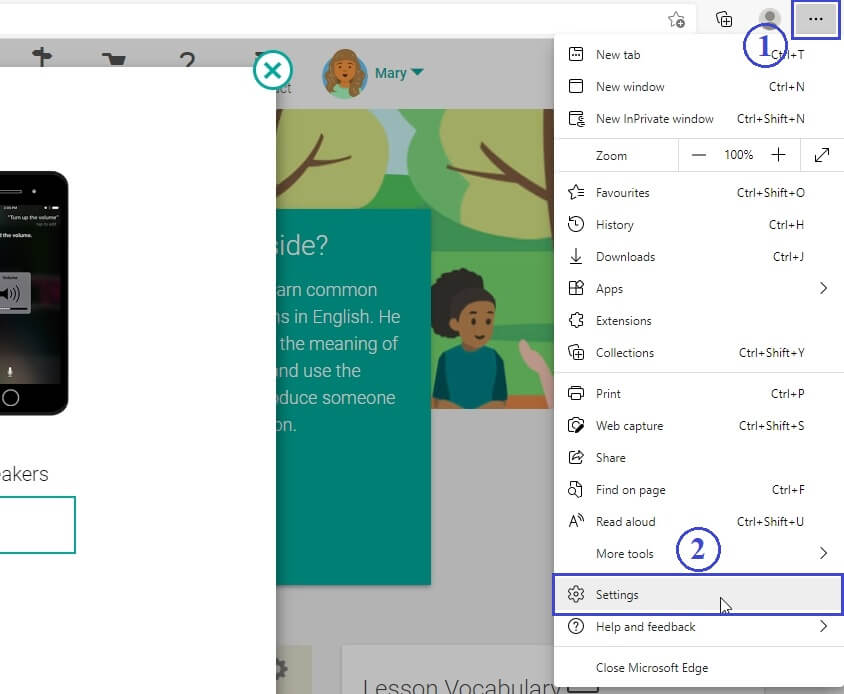

Click on the (1) Settings icon, then, click on the (2) Settings menu item.

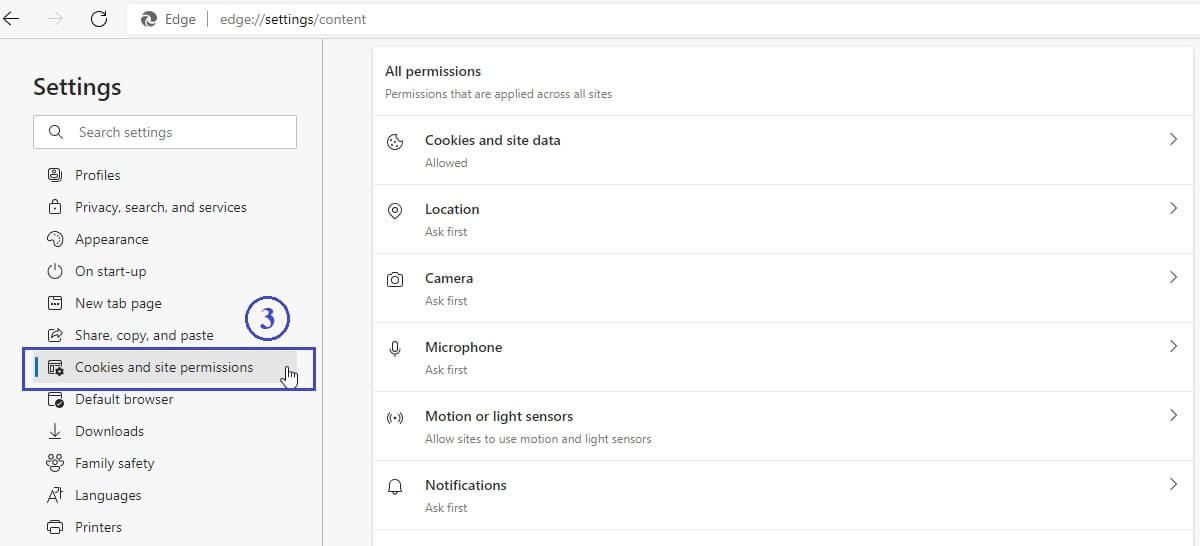

Click on (3) Cookies and site permissions.

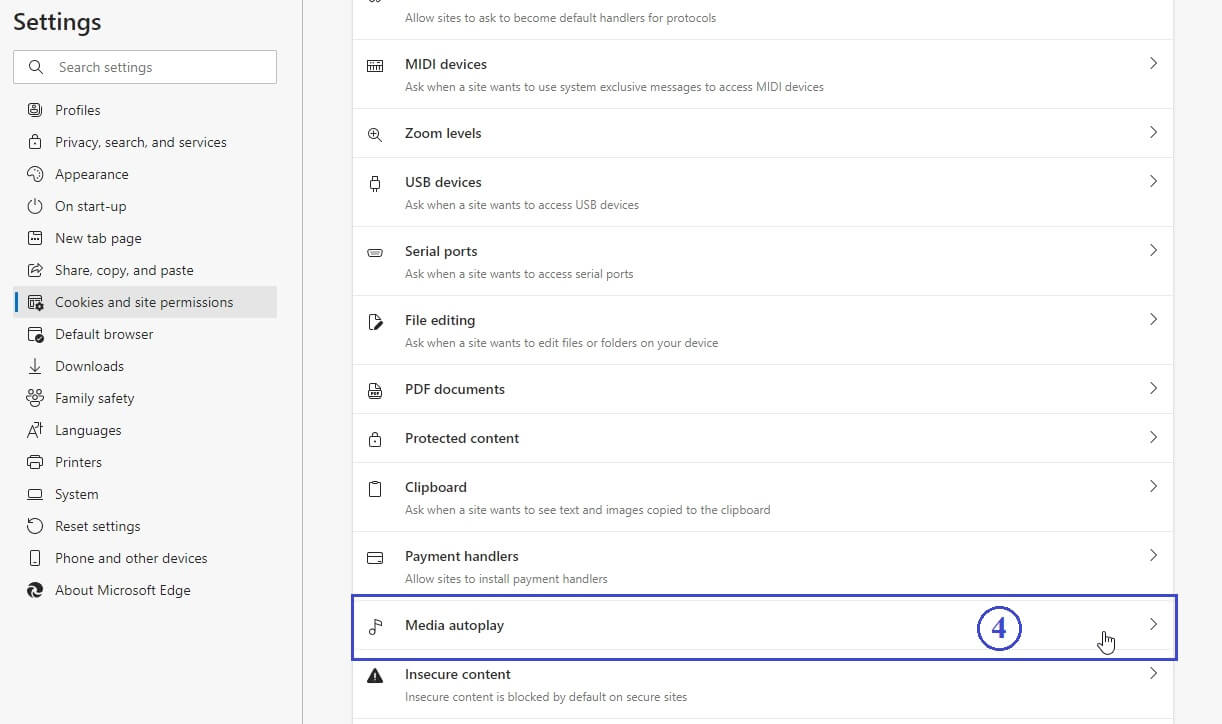

Click on (4) Media autoplay.

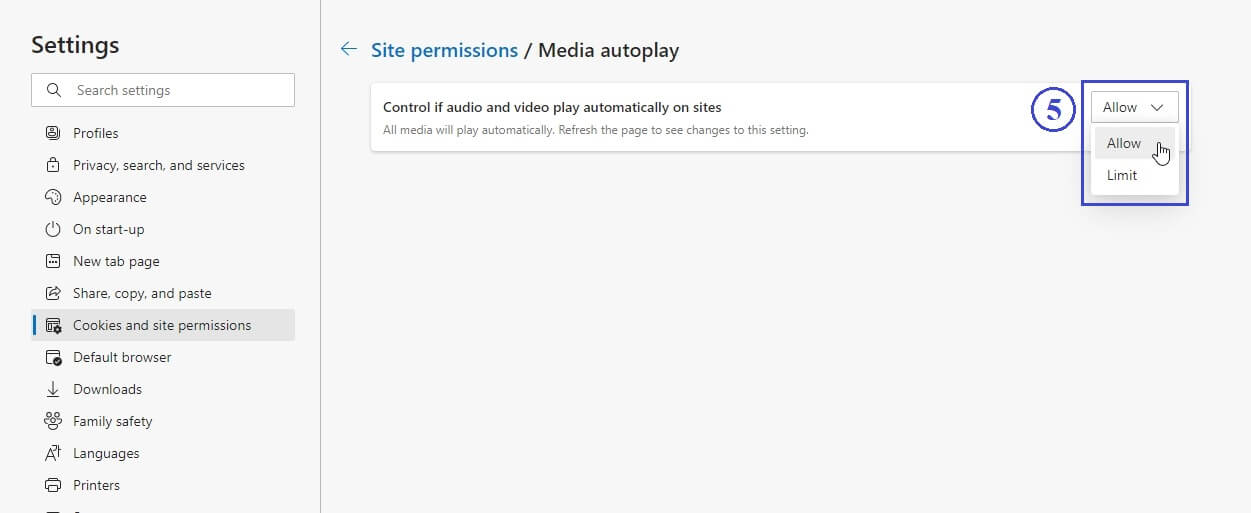

Select (5) Allow for "Control if audio and video play automatically on sites".

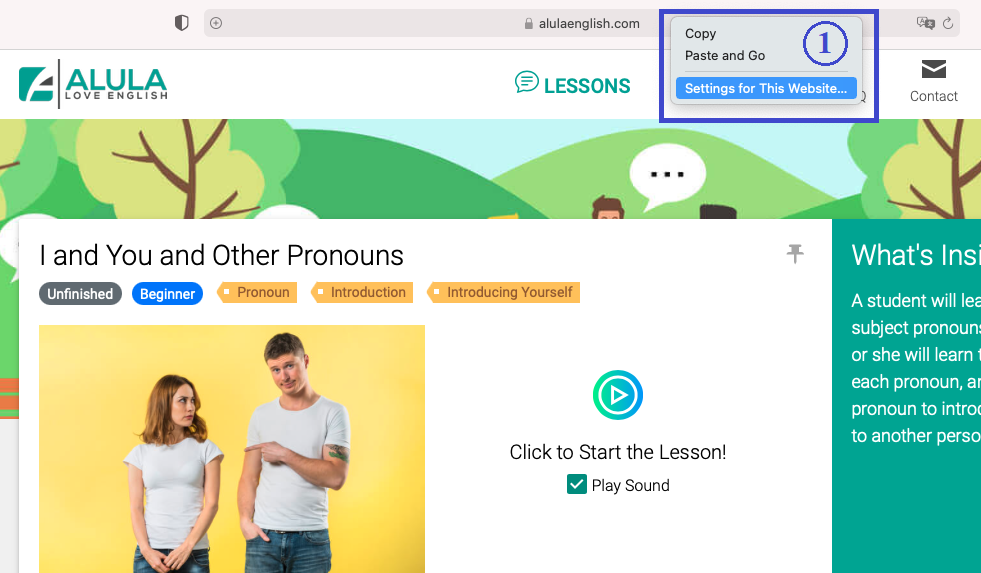

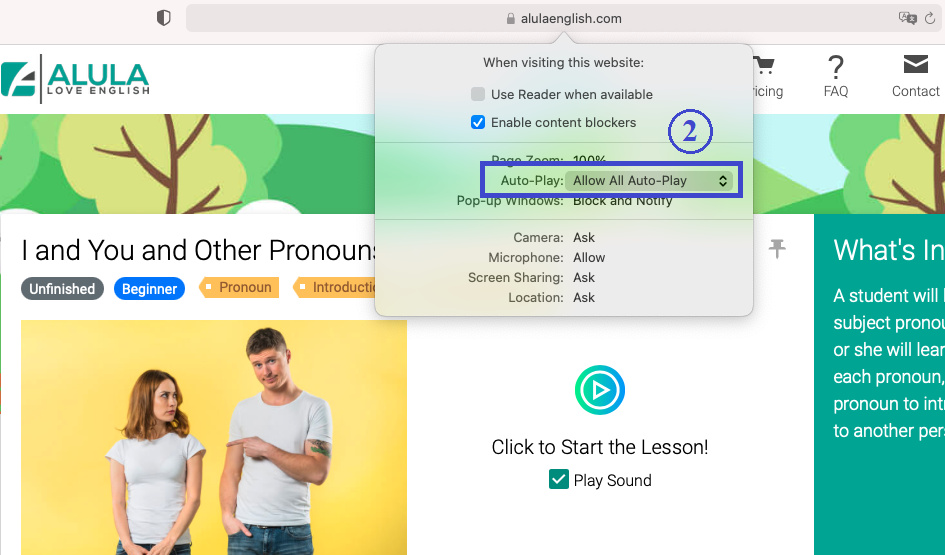

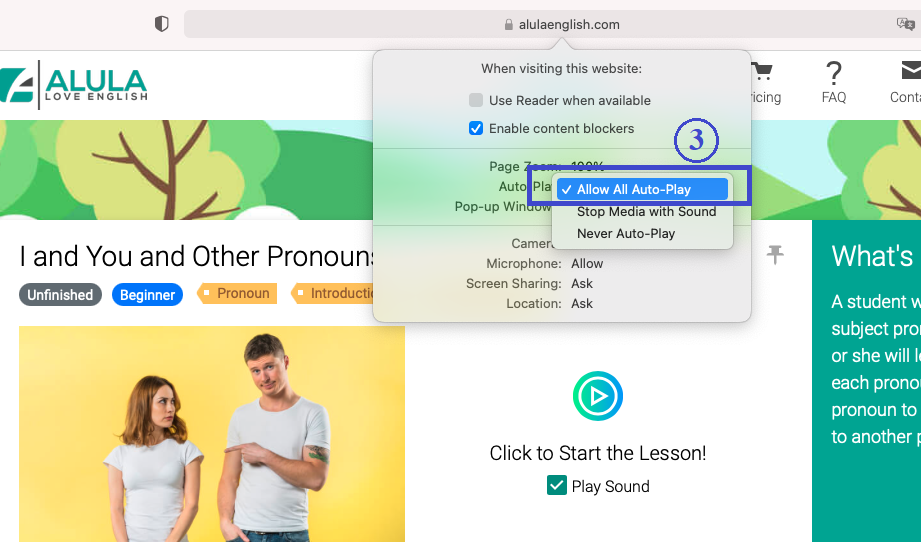

On the browser address bar, control-click, and select (1) Settings for This Website...

Click on the menu for (2) Auto-Play.

Select (3) Allow All Auto-Play.

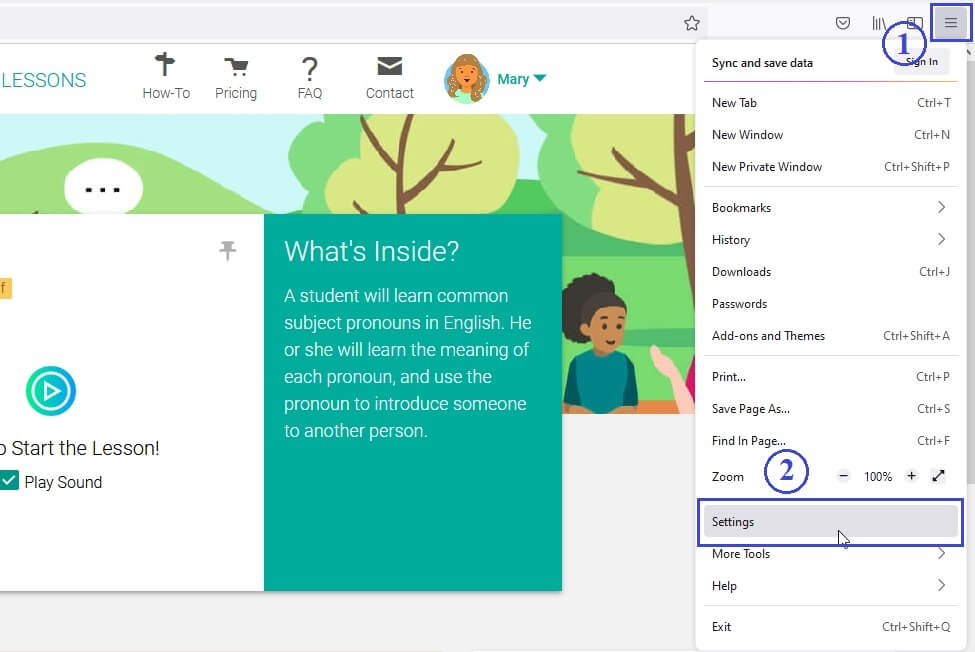

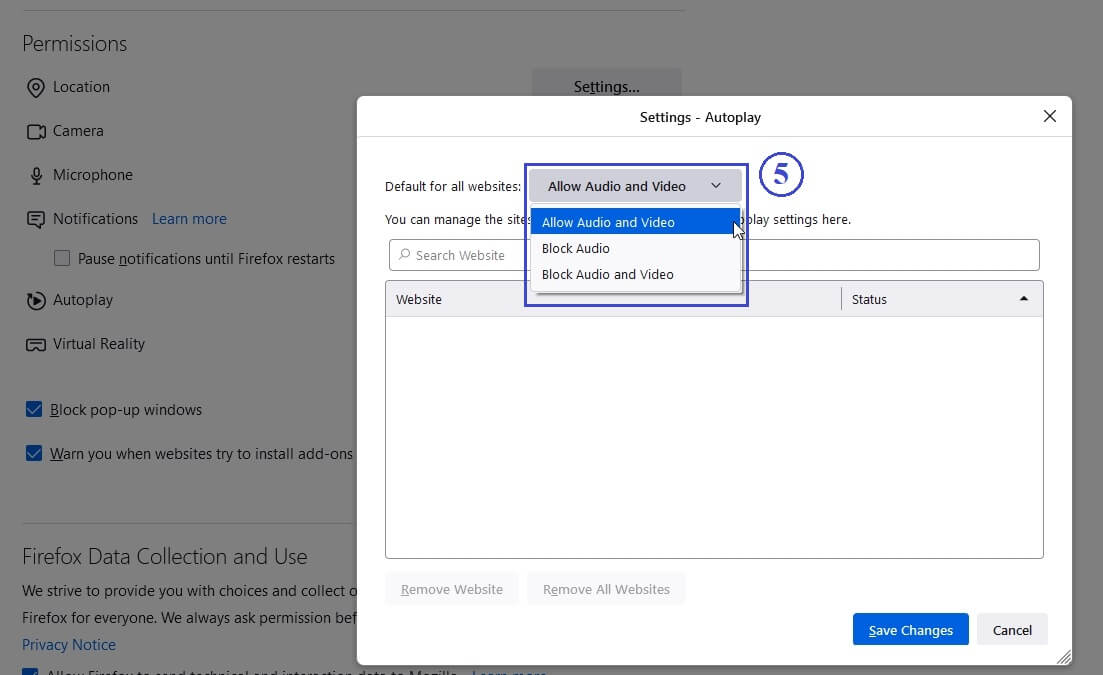

Click on the (1) Settings icon, then, click on the (2) Settings menu item.

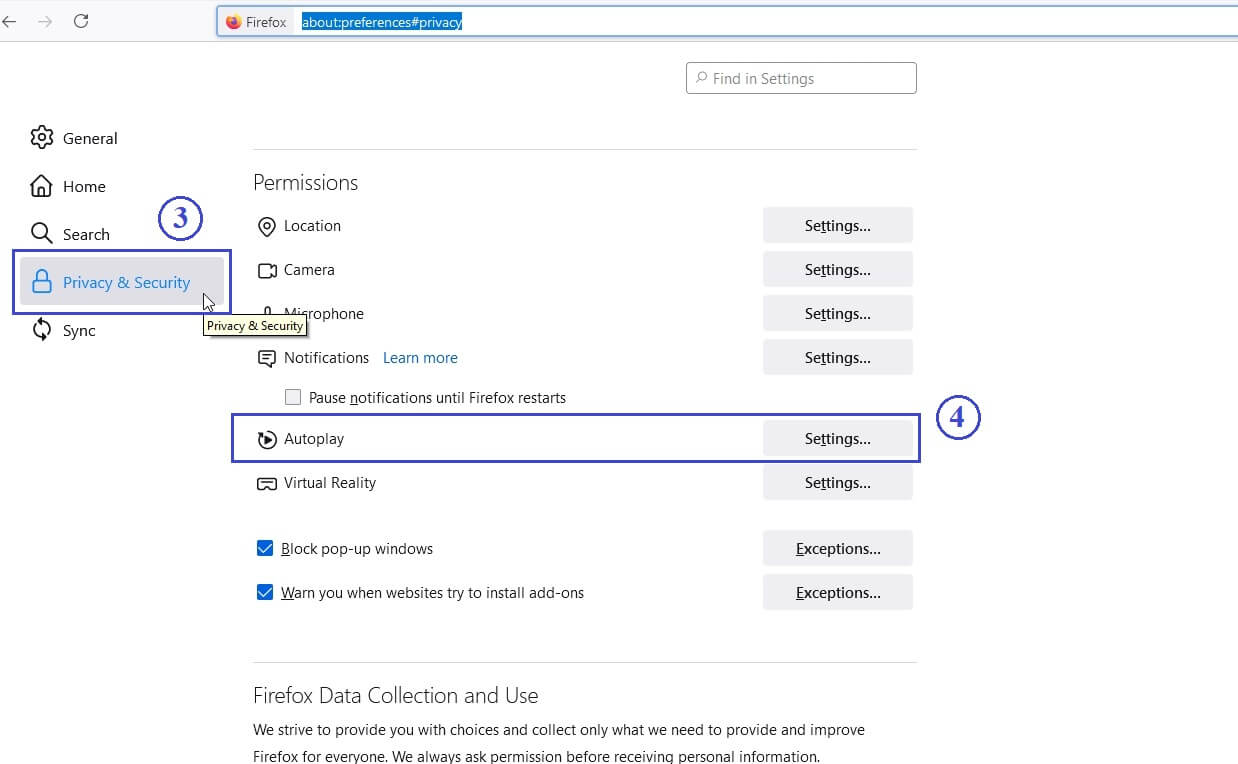

Click on the (3) Privacy & Security tab, then, click on the (4) Settings... menu item for Autoplay.

Select (5) Allow Audio and Video option.

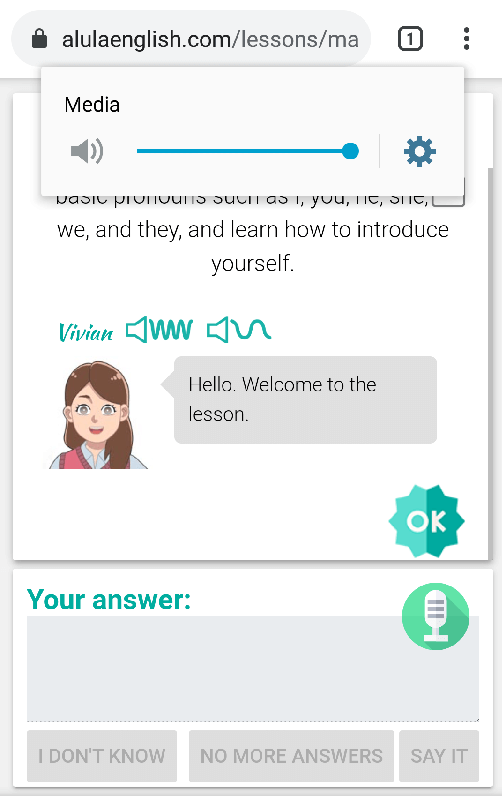

Click on the (1) Green icon on the browser bar, then, click on the (2) Sound dropdown and select "Allow".

Please make sure that your volume is turned up. Check that your device can play sound.

Please make sure that your volume is turned up. Check that your device can play sound.

Please turn up your volume. Also, please make sure your speaker is working.

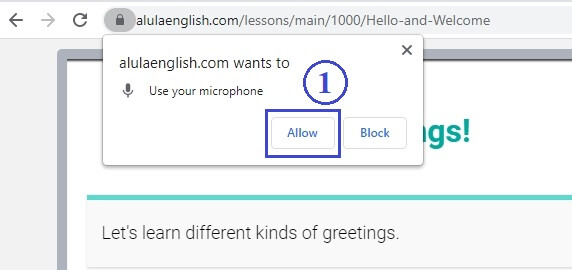

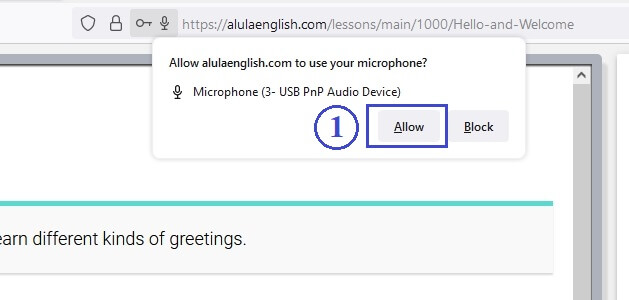

When the browser asks you, click on (1) Allow button.

If you blocked the microphone already, click on the (1) green lock icon, then select (2) Allow under Microphone dropdown.

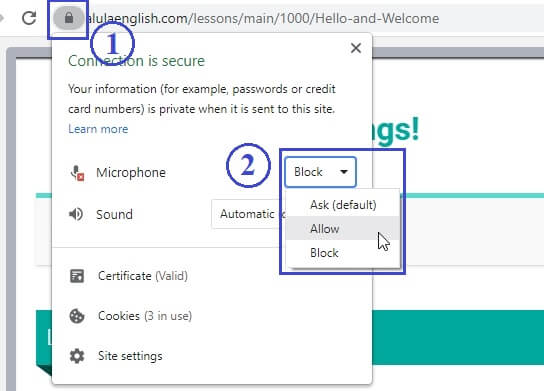

When the browser asks you, click on (1) Allow button.

If you blocked the microphone already, click on the (1) lock icon, then select (2) Allow under Microphone dropdown.

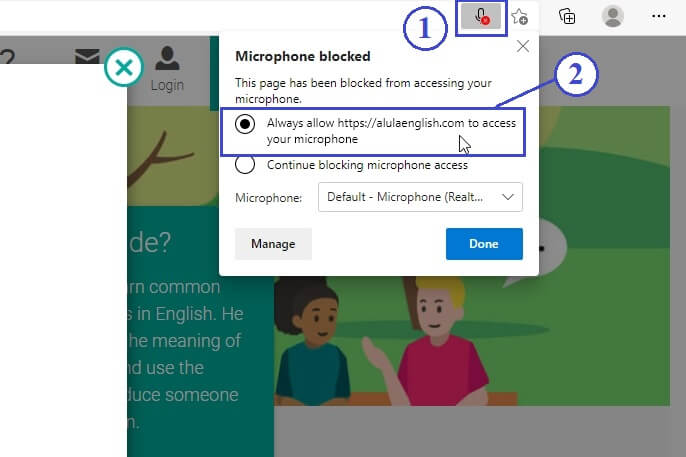

Sometimes, there is a (1) microphone icon at the right side. Click on it, then select (2) "Always allow https://alulaenglish.com to access your microphone".

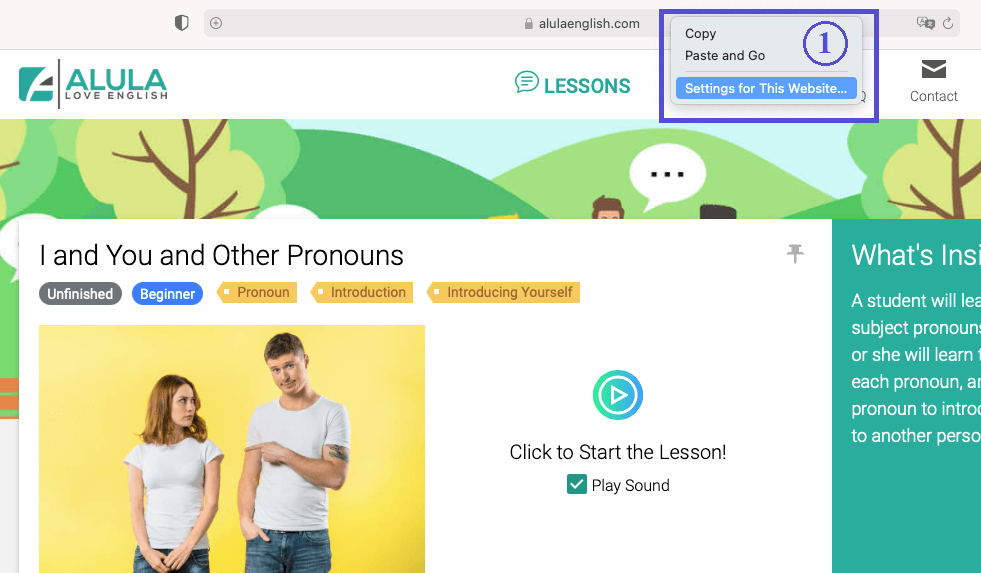

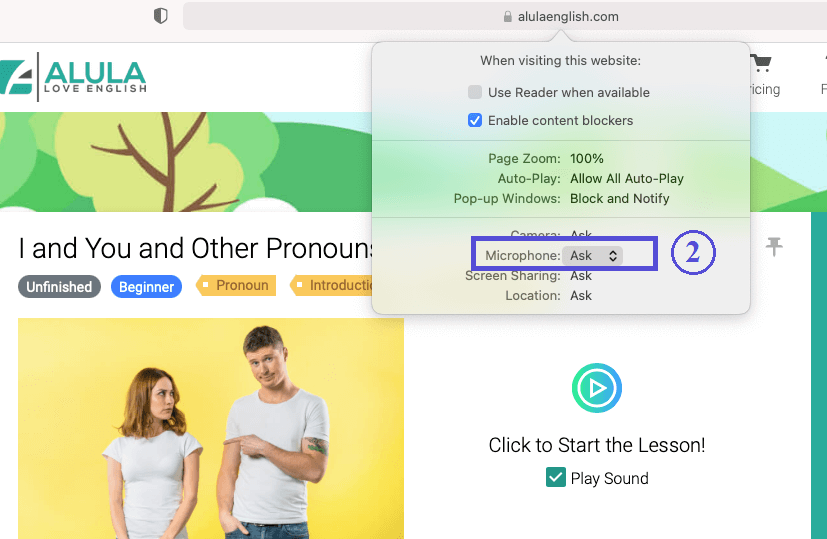

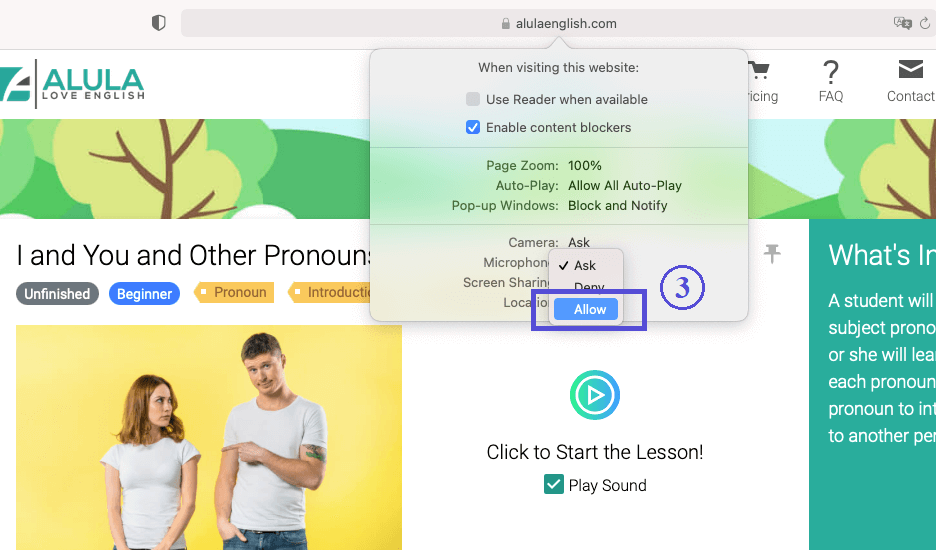

On the browser address bar, control-click, and select (1) Settings for This Website...

Click on the (2) Microphone dropdown.

Select (3) Allow.

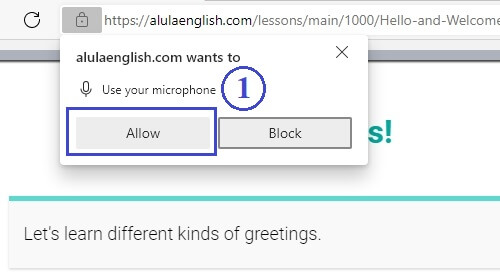

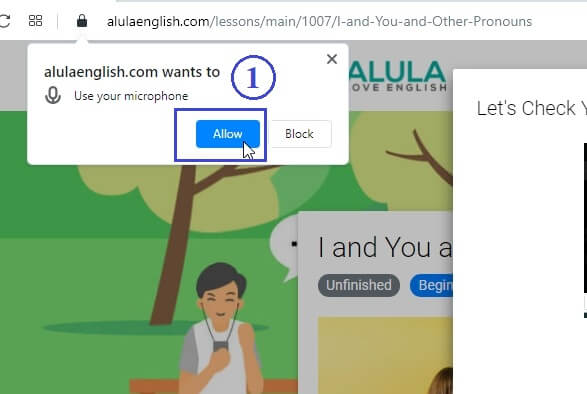

When the browser asks you, click on (1) Allow button.

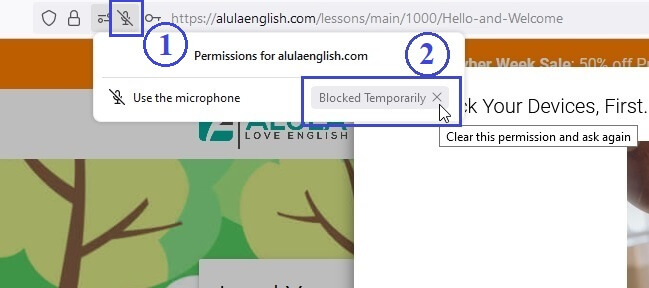

If you blocked the microphone already, click on the (1) microphone icon, then click the (2) X in the Blocked Temporarily button.

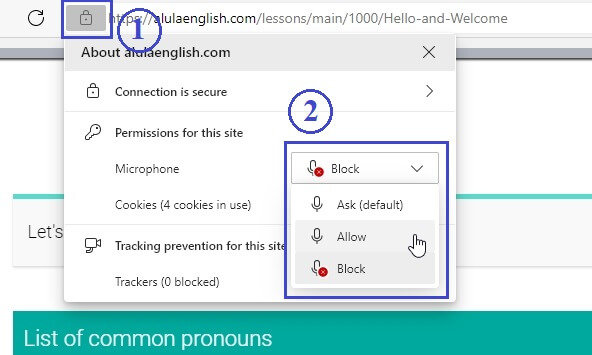

When the browser asks you, click on (1) Allow button.

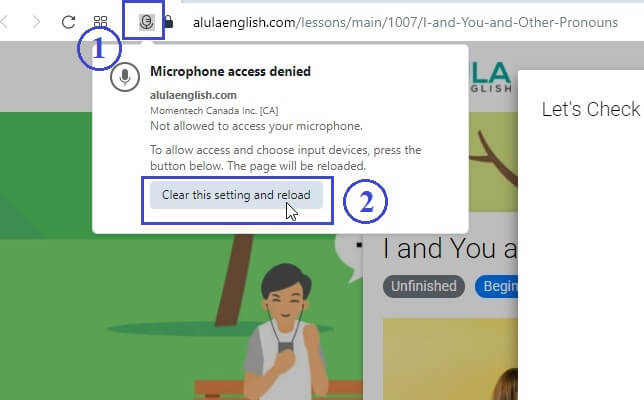

If you blocked the microphone already, click on the (1) microphone icon, then click the (2) Clear this setting and reload button.

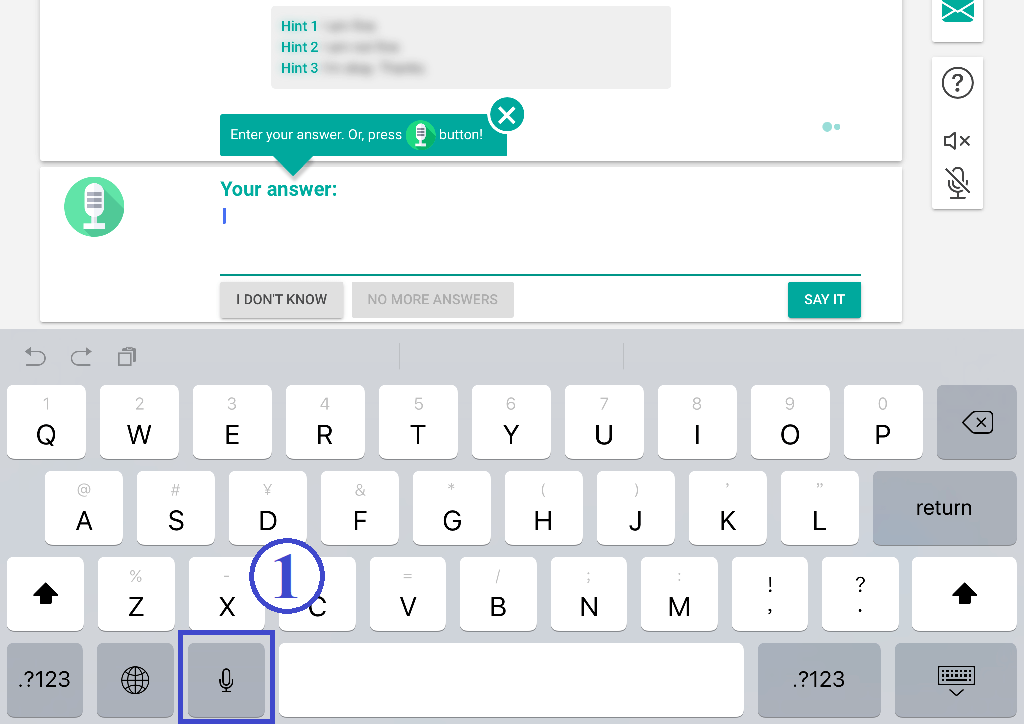

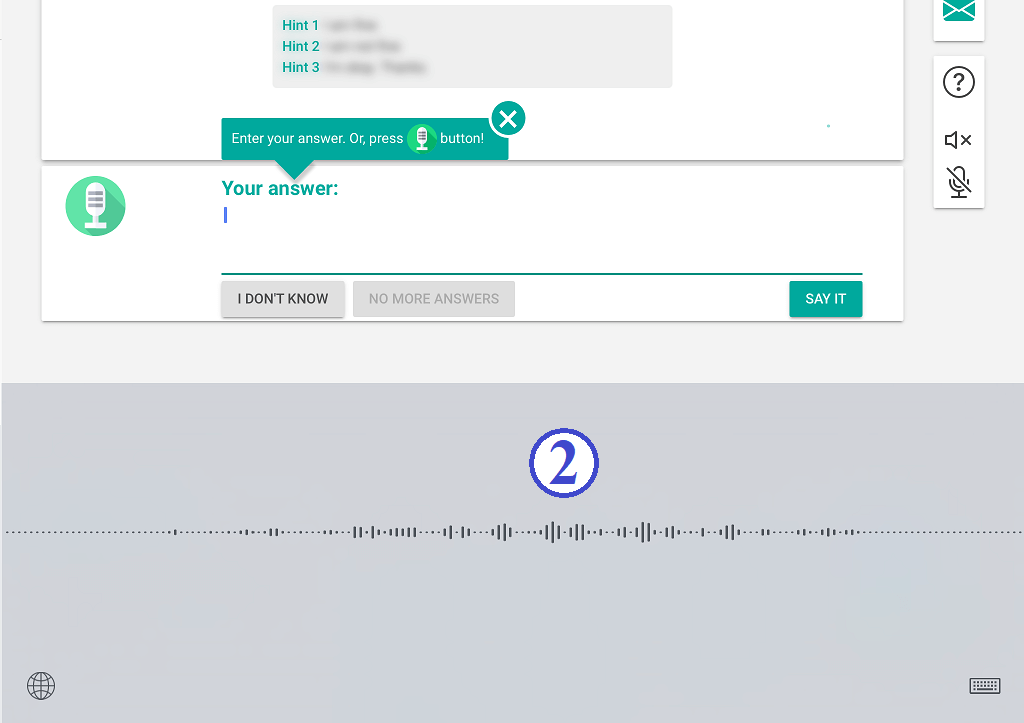

On your iPhone or iPad keyboard, click on the (1) microphone icon.

(2) Speak into your iPhone or iPad microphone directly.

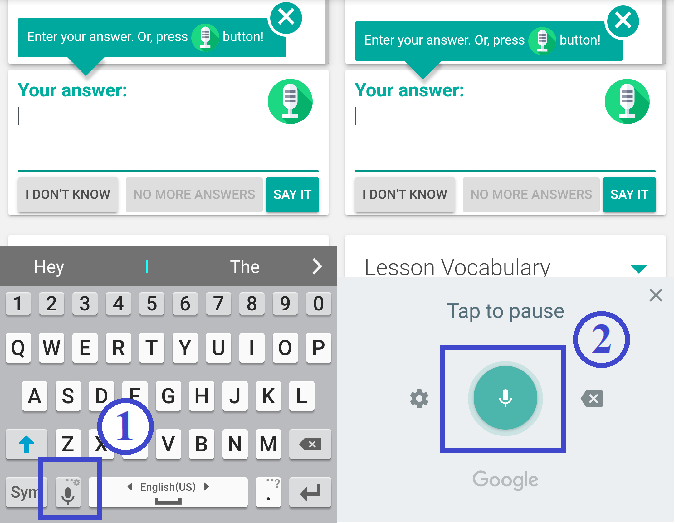

Click on the answer area and the Android keyboard will show up. Click the (1) Microphone button. Then, use (2) the Android voice recorder to record your voice.

ALULA le tuteur d'anglais IA

Droit d'auteur © 2024 Tous droits réservés

Apprenants ESL/EFL

Cours d'expression orale sur l'IA

Référence de grammaire pour débutants

Référence de grammaire pour débutants élevés

Créé par des experts en éducation, alimenté par l'IA et tout un tas de ♥

Il y a eu des erreurs et nous n'avons pas pu vous inscrire. Veuillez vérifier les informations que vous avez fournies.

Nous n'avons pas pu envoyer l'e-mail de confirmation à votre adresse e-mail. Veuillez vérifier votre adresse e-mail et réessayer.

Saisissez un nom d'affichage plus long.

L'adresse e-mail n'est pas valide.

Cet e-mail est déjà enregistré. Se connecter

Minimum 8 caractères.

En vous inscrivant, vous acceptez nos Conditions générales, Politique de confidentialité et Politique en matière de cookies.

La connexion a échoué. Veuillez vérifier votre adresse e-mail et votre mot de passe.

Votre email est vérifié avec succès. Veuillez vous connecter.

Un e-mail a été envoyé à votre adresse e-mail.

Cliquez sur le bouton dans l'e-mail pour vérifier votre adresse e-mail et activer votre compte.

L'e-mail vous est renvoyé. Si vous ne le voyez pas, vérifiez votre dossier spam.

L'e-mail n'a pas été envoyé en raison d'une erreur. Veuillez réessayer.

Nous pourrions trouver votre enregistrement de courrier électronique. Veuillez essayer de rafraîchir votre écran, puis connectez-vous à votre compte.

Cet email a déjà été activé. Connectez-vous.

Si vous ne voyez pas l'e-mail, cliquez sur le lien ci-dessous pour qu'il vous soit renvoyé.

Avis

Nous et nos partenaires sélectionnés utilisons des cookies ou des technologies similaires, comme spécifié dans la politique en matière de cookies.